PerformanceFund 1

Our performance fund will feature our highest conviction stocks. The portfolio’s (pre-launch) performance is 33% over nearly five years and 57% over the last three. While we cannot guarantee these results will be repeated over time, we employ time-tested value-investor principles, and our managers trust a large portion of their net worth in the portfolio.

Performance (average returns)

Our Portfolio

4.5 years

3 years

1 year

33%

57%

90%

S&P 500

12%

18%

17%

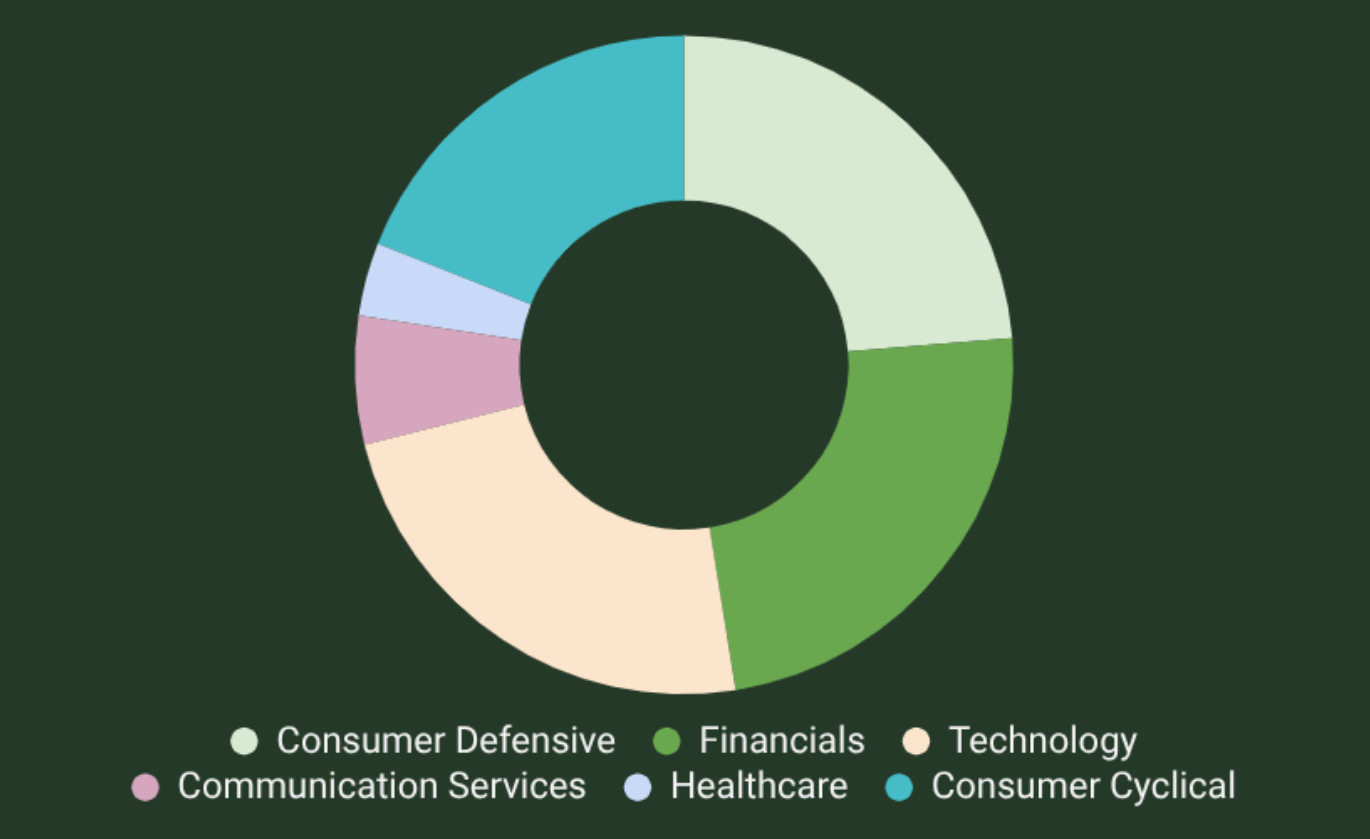

Sector Weightings:

Our approach:

Lead generation - from great products we discover in our personal life, filings from reputable investors, or from our AI to scan across 3,000+ companies, finding potentially underpriced stocks

Ensure we can understand the business well

Evaluate the business’s economic characteristics and room to grow

Evaluate the business’s competitive qualities

Evaluate the business manager

Ensure the business is trading well below its intrinsic value

If the opportunity looks promising, compare it to the best opportunities already within our portfolio

Several times a year, adjust portfolio weightings as price fluctuations change the appeal of our positions